As per Rule 67A of the CGST Rules, 2017, as substituted vide Notification No. 58/2020-Central Tax, dated 01.07.2020, filing of Nil GSTR-1 can be made through SMS from 01.07.2020. Needless to mention here that filing of Nil GSTR-3B has already been enabled from 08.06.2020.

- Of all of your SMS Assist work orders. Our Affiliate Support Team can help! Call 844-778-9578 or email affiliatesupport@smsassist.com.

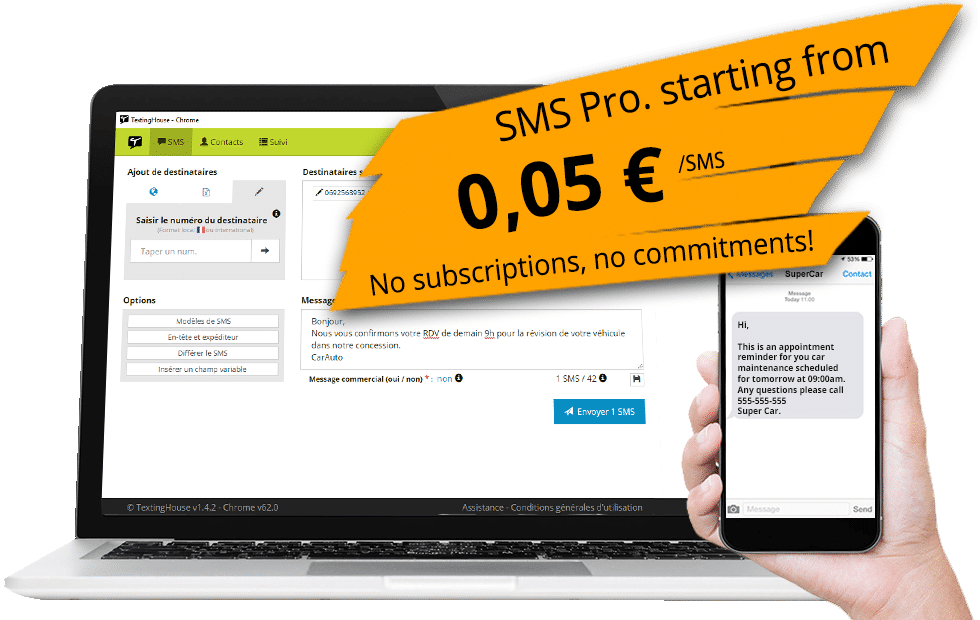

- A leading service provider offering two-way SMS communication from anywhere at any time. Register your account today. One Account, Many Ways to Send.

In order to help out the registered persons to file NIL GSTR-1 through SMS the common portal has come up with advisory in this regard on 01.07.2020, which is given below for ready reference of our readers.

- A taxpayer may now file NIL Form GSTR-1, through an SMS, apart from filing it through online mode, on GST Portal.

- To file NIL Form GSTR-1 through SMS, the taxpayer must fulfil following conditions:

- They must be registered as Normal taxpayer/ Casual taxpayer/ SEZ Unit / SEZ Developer.

- They have valid GSTIN.

- Phone number of Authorized signatory is registered on the GST Portal.

- No data should be in saved or submitted stage for Form GSTR-1 on the GST Portal, related to that respective month.

- NIL Form GSTR-1 can be filed anytime on or after the 1st of the subsequent month for which the return is to be filed.

- Taxpayer should have opted for the filing frequency as either monthly or quarterly.

- NIL Form GSTR-1 for a tax period must be filed by the taxpayer if:

- There are no Outward Supplies (including supplies on which tax is to be charged on reverse charge basis, zero rated supplies and deemed exports) during the month or quarter for which the return is being filed.

- No Amendments is to be made to any of the supplies declared in an earlier return.

- No Credit or Debit Notes to be declared/amended.

- No details of advances received for services to be declared or adjusted.

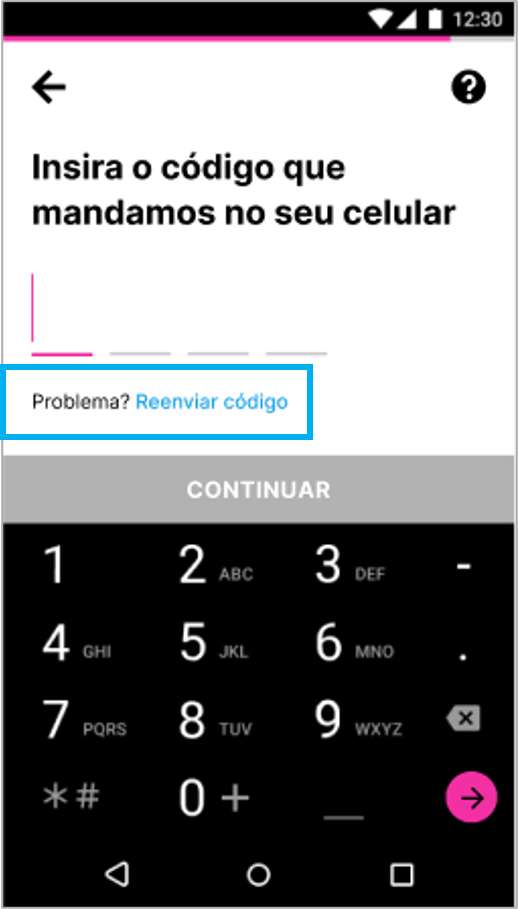

- Steps to File Nil Form GSTR 1 through SMS is as below:

- Send SMS to 14409 number to file Nil Form GSTR-1 – NIL space Return Type space GSTIN space Return Period

- For Monthly Filing for Tax Period April 2020: NIL R1 07AQDPP8277H8Z6 042020

- For Quarterly Filing for Tax Period Apr-Jun 2020: NIL R1 07AQDPP8277H8Z6 062020

- Send SMS again on the same number 14409 with Verification Code (For Example: Verification Code received here is 324961) to confirm filing of Nil Form GSTR-1.- CNF space Return Type space Code – CNF R1 324961

- After successful validation of “Verification Code”, GST Portal will send back ARN to same mobile number and on registered e-mail ID of the taxpayer to intimate successful Nil filing of Form GSTR-1 .

- Send SMS to 14409 number to file Nil Form GSTR-1 – NIL space Return Type space GSTIN space Return Period

- All the authorized representatives, for a particular GSTIN can file NIL Form GSTR-1 through SMS.

The SMS Assist difference; One by SMS Assist™ Manage work orders, streamline processes, and control costs. Our provider network More than 20,000 vetted and qualified providers ready for work in 45 trades.; Our dedicated teams Experts working around the clock so you can focus on growing your business. Explore Latest Collection of Love SMS here. The following words best describe this page. Love SMS, Love Text Messages, Love Quotes, Loving SMS, Loving Messages, Liking SMS, Liking Messages, Lovely SMS, Lovely Messages, I Love You SMS, I Love You Messages, Latest Love SMS Collection, Romantic Flirt SMS.

User guide on filing of NIL GSTR-1 through SMS has also been provided on the common portal which are given below for ready reference of our readers.

FAQ-on-GSTR-1-thu-SMS

***

1ms Controller Input Delay

A BIG THANKS to you for visiting our site. You are also requested to go through the articles on topical issues in GST penned down by our expert team.

Doubts on GST may also be lodged on ‘Ask GST query tab‘ under ‘Your GST queries’ tab on home page. National level GST experts will provide their reply on the matter raised at the earliestand same can be seen under ‘GST query resolved’ tab under ‘Your GST queries’ tab. Persediaan meteor shower.

You can also subscribe to our free newsletter to always be updated on GST Law by filling the subscription form at home page.

BulkSMS.com in South Africa

Get your messages across with BulkSMS.com. Use any or all of our SMS Messaging Solutions whenever you need to. Using our platform, you can quickly send any short and important SMS messages worldwide, or locally to South Africa. You can easily send transactional messages like one-time passcodes and SMS alerts, or promotional messages from your CRM system or sales desk. Look at our case studies to see how our customers are using our SMS gateway.

What you need to know when sending SMS messages to South Africa.

BulkSMS offers two different types of Incoming Numbers to our South African market. The most popular is the Premium Rated SMS (shortcodes). This is a 5-digit shortcode typically used for competition entries, lead generation and donations. Our Incoming Long Numbers behave exactly like a mobile number except that all messages sent to that number will come directly into your BulkSMS account.

We also offer unique pricing for non-profit organisations, schools etc. Click here for pricing for non-profit organisations.

SMS Regulations in South Africa:

South Africa has a robust and strict regulatory environment when it comes to the mobile messaging industry. The Wireless Application Service Providers’ Association (WASPA) is a self-regulating body and offers the WASPA Code of Conduct that we, as a WASP are required to adhere to. This Code of Conduct also offers guidance on the key requirements for SMS marketing, as well as key requirements for premium rated services, otherwise known as SMS Shortcodes. Click the link for further information on the SMS Regulations in South Africa.

Reverse Billing Regulations for the Short-term Insurance Industry:

1 Sms Berapa Karakter

Companies sending promotional SMS messages using normal bulk messaging accounts don’t generally cover the costs of SMS replies. But now, companies operating in certain industries legally have to. For more information on these regulations please read the Regulations on Reverse Billing for the Short-term Insurance industry.